A WOKING ward councillor has urged the council to make public all the documents relating to the borrowings which ultimately led to its bankruptcy.

Cllr Louise Morales, a Liberal Democrat who represents Hoe Valley and is the borough deputy mayor this year, believes the scrutiny would bring a greater understanding of just how the council managed to run up a debt which is forecast to hit £2.6billion.

At present, many of the documents relating to the council’s borrowings are classified as ‘Part 2’, which means they can be viewed by councillors but are not in the public domain.

“I’ve been going on about the debt for years and the need for people to understand it and now the urgency seems greater than ever,” said Cllr Morales.

“I’ve been told that one of the problems with bringing the documents out of Part 2 is that you need the permission of any bodies beyond Woking Borough Council which are mentioned. But why not release the documents with those names redacted? At least the substance of the decisions would be out in the open.”

Cllr Morales, a consistent critic of the scale of the council’s borrowing to fund its flagship projects at Victoria Square and the Sheerwater Regeneration, addressed the extraordinary meeting of the council last week, and wasted no time drawing attention to the council’s book-keeping.

“I was elected in 2011 and the first executive meeting I attended was about the council’s purchase of Wolsey Place for £68million,” she said. “Within months it had been valued at many millions less.

“Many of the minutes of the council taking out loans are still in Part 2,” she went on, adding pointedly, “but I’m not allowed to tell you about them.”

The meeting was available as a webcast and so open to the public.

“I’d argued repeatedly that the income assumptions simply didn’t make sense. Rental income, car parking income, all sorts of income, all the assumptions were much higher than we were likely to receive. They didn’t make sense.”

Yet if this was evident to Cllr Morales, who makes no claim to specialised financial knowledge – “I’m a gardener, I spend my day pushing wheelbarrows, but that does give me time to think” – why did her fellow councillors largely fail to exercise the same scepticism?

“They didn’t engage their brains,” she said. “Although I’m advocating greater access for everyone to the relevant documents, the fact is that the evidence was right there in front of them. It was as though they’d turned their backs on ‘normalness’.

“I don’t represent a wealthy area and I know the people there would apply a totally different yardstick.

“They’d say if something was just too expensive, or if it was a long time to pay it off. They wouldn’t have to be told if they couldn’t afford something.

“It’s funny, it’s as though the more people become used to handling very large numbers in terms of money, the more they come to see risk almost as a lottery, rather than something that can do real damage.

“In one presentation, the best, middle and worst case scenarios were interest rates at one per cent, two per cent and three per cent. Worst case three per cent interest over 50 years. Just look at today, interest rates now. It was totally unrealistic.

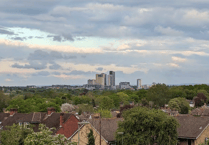

“And I think some councillors couldn’t see beyond the image of the towers of Woking. ‘How advanced we are here,’ that kind of outlook.

“Perhaps not enough took advantage of the financial training sessions either.

“A note I’ve got here from 2017 shows 18 out of 30 councillors turning up for the session, not that many really.

“And another about when the financial plans for ThamesWey were discussed. There were ten present.

“In their defence, though, I do believe senior council officers fostered a sense of complacency. If anyone raised any legal or financial questions they were soon reassured by a ‘professional opinion’ that ‘that’s okay’.

“But okay was never strong enough, it needed to be a lot more than that.

“I’ll give you a small example of the council’s thinking on debt. It wanted to put in a 3G pitch by the Leisure Centre for £5m, but how to pay for it? Well, we’ll charge people to park in the car park after 30 minutes.

“Residents won’t stand for it, they were told, you can’t charge young mothers with children for parking after 30 minutes. So as the day got nearer they lost their nerve and dropped the proposed charge.

“In the end they had a £5m debt and no income.”